10 Minute Guide to College Financial Aid

There is a ton of information on the Internet about college financial aid, some of it conflicting, some of the pointless, some of it actually helpful. My goal for this guide is for you to spend 10 minutes of your time getting answers to some of your college financial aid questions without spending three hours searching on Google!

Here's what we'll cover for the basics of college financial aid:

· How need-based financial aid actually works (which includes computing your Expected Family Contribution and what it means for you)

· The difference between FAFSA and the CSS Profile when calculating your chances of getting need-based aid

· Merit-based financial aid

· Private scholarships

You've probably heard by now that college costs have been going up faster than inflation for quite some time. And you probably know that the "sticker price" of a college is not necessarily what you will actually have to pay to send your child to that school. The difference between the full sticker price and what you pay is mostly based on financial aid. And financial aid comes in two main varieties:

- Need-based aid

- Merit-based aid

Need-based aid is help your family can get based on a variety of financial factors (primarily your family's income). Merit-based aid is NOT based on need, but instead typically based on your student's grades, test scores, and in some cases, athletics.

Need-Based Financial Aid

Need-based aid is determined by a value called your "Expected Family Contribution", or the EFC. When most families first see their EFC number, their first question is typically "per year??". Your EFC is what you are expected to be able to pay for college each year. It is almost always far higher than what you actually think you can pay each year. You can estimate your family's EFC here to get a feel for where your family falls: https://www.savingforcollege.com/financial-aid-calculator/

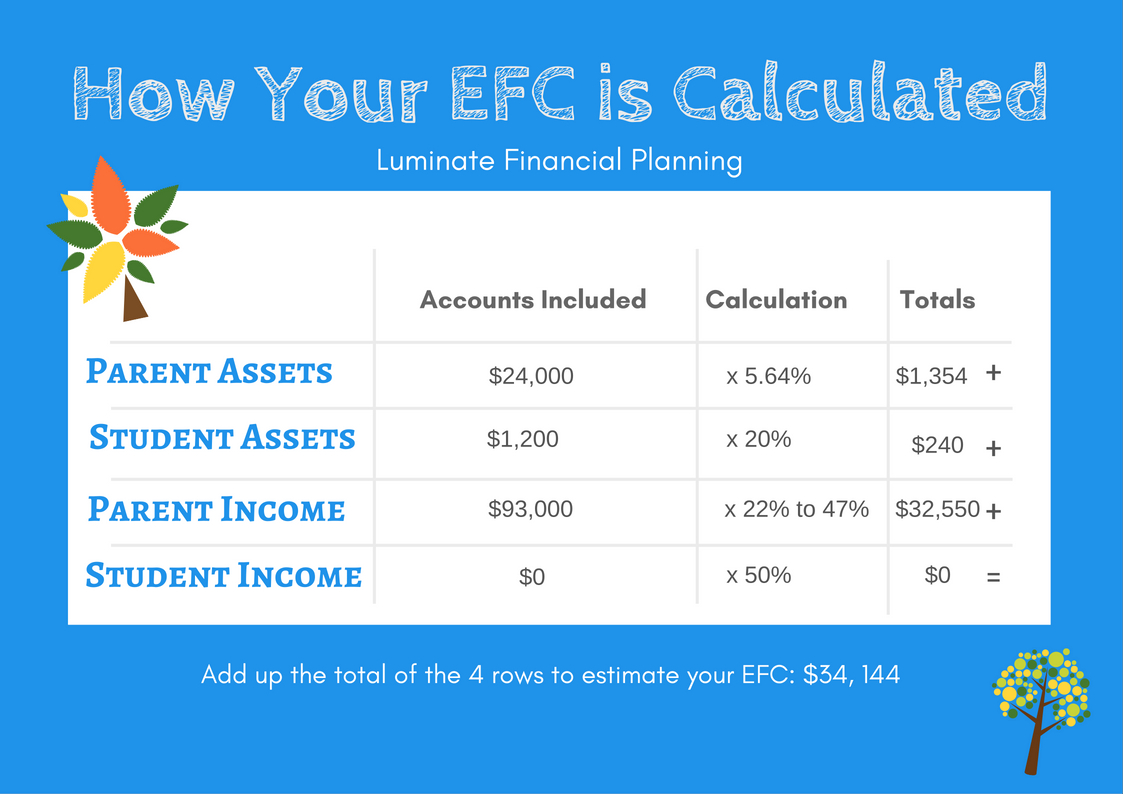

Here's an overview of how your EFC is calculated:

I’m not going to get into all the details of how expected family contribution is calculated here, but I want you to understand the main components of your EFC. The biggest driver by far of the EFC calculation is your family‘s income. Spoiler alert: the financial aid people do not care if you live in a high cost area. I live in Northern Virginia where high incomes are pretty normal (along with a high cost of living). The financial aid folks don’t care.

After income, the next biggest driver of your EFC score is your assets. They will only look at your assets that are outside of retirement accounts, so don’t worry, your IRA, 401(k), pension, etc. will not be taken into account.

The accounts they will be asking about are your checking account, savings account, any brokerage accounts you have, and of course, your 529 college savings account. Learn more about 529 plans here! They are only going to include 5.64% of each of these balances when they calculate how much you are expected to pay. Compare this to your income, where they'll include more like 30-40% of your income. Even though income has the biggest impact, it is true that if you have substantial assets outside of the retirement accounts, that will start to hurt your EFC picture.

CSS Profile vs FAFSA

The topic gets more complicated based on which schools your child is applying to. Most schools and especially most public schools will simply use the FAFSA. Other schools like the more elite private schools are going to use something called the CSS Profile, which will go even more in depth to your personal financial situation. You can find a list of schools that use the CSS Profile here.

The CSS Profile is similar to the FAFSA in that the main driver of your score is based on income. Whereas the FAFSA is fairly basic and shouldn't take more than 30 minutes to complete, the CSS Profile is much more detailed. Unlike the FAFSA, the CSS Profile also looks at home equity. The CSS Profile will also include cash value insurance policies and non-qualified annuities, which the FAFSA excludes. The FAFSA and CSS Profile each treat divorce situations differently as well. The FAFSA only asks for the income and assets of the parent who the student lives with more than half of the time. The CSS Profile will look at both parents' income and assets.

How to Estimate Your Financial Aid Now That You've Calculated Your EFC

First, look at the full cost of going to a particular school. It’s called the COA, “Cost of Attendance”, and you can find it on any school’s website. Then take your EFC and subtract that number from the cost of attendance at the school. The difference between the cost of attendance and your EFC number is the amount of need-based aid that you could possibly receive. Not that you necessarily will, but this is the maximum you will get based on need.

Let’s look at an example to make this a little more clear. Let's say your child wants to go to James Madison University in Virginia. Total cost of attendance for one year of in-state tuition at James Madison University is $25,780 for the year 2017–2018. Now let’s assume you've done the EFC estimate, and your family's expected family contribution is $34,000. So, we take the cost of attendance at JMU ($25,000), and we subtract your EFC number ($34,000). Since your EFC is higher than the cost of attendance of the school, you will not qualify for any need-based aid there.

Here's an example breakdown of the family with an EFC of roughly $34,000:

Now let’s take that same family, and assume the child also wants to attend Bucknell University in Pennsylvania. The cost of attendance at Bucknell is $70,125 per year. To estimate your need-based aid eligibility, we take the $70,125 cost of attendance, subtract your $34,000 EFC for a difference of $36,125. That means your family is eligible for $36,125 in need-based aid each year. Again, that doesn't mean you'll get the full $36,125 in aid, it just means you are eligible for that much. Some schools are really good at giving 100% of the need-based aid you show, but most will typically help with about half of what you are eligible for. So, best case, you would pay $34,000 (your EFC) each year to send your child to Bucknell (assuming they covered 100% of your need-based aid). If they don't cover all of your need-based aid, you'll pay more.

So the EFC by itself is almost meaningless. To understand financial aid you have to compare your family's EFC to the cost of attendance for the specific school. The same family might qualify for lots of aid at an expensive school, but no aid at most cheaper schools.

If you are a family that might qualify for need-based financial aid (if your EFC is lower than most of your child’s college picks), you'll want to reduce your EFC as much as possible. Unfortunately, there isn't a whole lot you can do to lower your EFC dramatically since it's mostly tied to your income, which is hard to change. Since some of your EFC is driven by assets, there are a few things you can do to help lower your EFC. The important thing is to understand which assets impact your EFC and which ones don't. For example, retirement accounts are not looked at, so it's better to have your assets in an IRA than a regular taxable brokerage account. The FAFSA also doesn't look at home equity, so paying down your mortgage faster will take cash out of your savings account (and into home equity), which will lower your EFC. Assets held in your child's name will also hurt your EFC. If it's in the child's name, 20% of it goes toward your EFC. If it's in the parent's name, only 5.64% goes toward the EFC. Saving in a Roth IRA is also sometimes a good idea. You can always pull out any funds you contributed to a Roth IRA (just not the earnings) tax-free and penalty-free to be used to pay for college. The advantage here is that the Roth IRA assets aren't included as part of the EFC calculation. There are other restrictions, so be sure to run this strategy by a financial planner before implementing it.

Merit-Based Scholarships

If you are now despairing of ever getting need-based aid, there is a whole other category of financial aid based on merit. Merit-based aid is often based on your child's academic achievements -- things like GPA, SAT scores and ACT scores. It can also be based on leadership skills, community involvement, music, and athletics.

Many of the most prestigious colleges don't give ANY merit-based aid for academics. Otherwise every kid at Harvard would probably qualify for a merit-based scholarship! The prestigious schools are very generous with need-based aid, but don't expect any merit-based aid at all.

There are plenty of private schools that offer generous merit-based aid/scholarships. The trick is to find schools where your child falls in the top 25% or even top 10% of a school's academic scores (GPA/SAT/ACT). Every school wants their freshman class to have a high overall test score average to improve the school's rankings. If your child will help improve their test score average, they may be able to get a merit-based scholarship.

Some schools even go so far as to have automatic scholarships based on test scores. The University of Alabama offers a whole list of scholarships for out-of-state students based purely on ACT/SAT and GPA. For example, if your child has an ACT score of 27 and at least a 3.5 GPA, they are automatically eligible for a $6,000/year scholarship ($24k over 4 years). The scholarships go up from there, with the Presidential scholarship paying $26,000/year for students who have an ACT score of 32 and a GPA of 3.5.

If your student is right on the bubble of getting to the next level in test scores (and therefore scholarships), it may make sense to invest in high quality test prep to help them improve their scores. Khan Academy offers excellent SAT prep courses for free online. If you live in the Northern Virginia area, check out OpenBook Academics with Shawn Sell in Leesburg and Inspiring Test Prep with Kate Dalby in McLean. Both offer excellent one-on-one test prep.

Collegedata.com is a great resource for finding information about cost of attendance, need-based aid and merit-based aid at different schools.

Private Scholarships

Besides institutional merit-based scholarships, there are also lots of private scholarships available to students willing to write the essays and complete the applications. Private scholarships are generally smaller than those offered directly by the schools, but they can add up! Scholarships360 is a great resource for finding private scholarships. You should be aware that some schools will reduce the need-based aid they offered your student based on any private scholarships your student receives.

College is expensive, but it still offers the best path to a solid career for many students. You can save on the cost of college by looking for schools that will fall within your family's budget once you've factored in financial aid. You'll want to look at the net cost to your family (net of aid) rather than the full on cost of attendance at a school. With a bit of preparation ahead of time, you can find a great college for your child that won't break the bank!

Disclaimer: This article is provided for general information and illustration purposes only. Nothing contained in the material constitutes tax advice, a recommendation for purchase or sale of any security, or investment advisory services. I encourage you to consult a financial planner, accountant, and/or legal counsel for advice specific to your situation. Reproduction of this material is prohibited without written permission from Alyssa Lum, and all rights are reserved. Read the full Disclaimer.