If you've got a child entering college in the near future, hopefully, you've also got a 529 account in place and ready to cover some of the costs of tuition and all the other associated expenses. Keep in mind, you can withdraw money from a 529 plan at any time for any reason.

Read MoreThere are so many decisions to make when your child is approaching college age. My own daughter is a junior in high school right now, and I can tell you firsthand that the choices, opportunities, and possibilities seem endless! Among the first decisions you should consider is whether community college is a good fit for your child.

Read MoreBe honest: what do you think when you hear the word budget? If you are like most people, maybe you think about spreadsheets and restrictions and self-denial and past failed attempts at reigning in your Amazon purchases.

First, let's call it a "spending plan", not a budget. Semantics, I know, but putting it in terms of spending puts you in the right mindset.

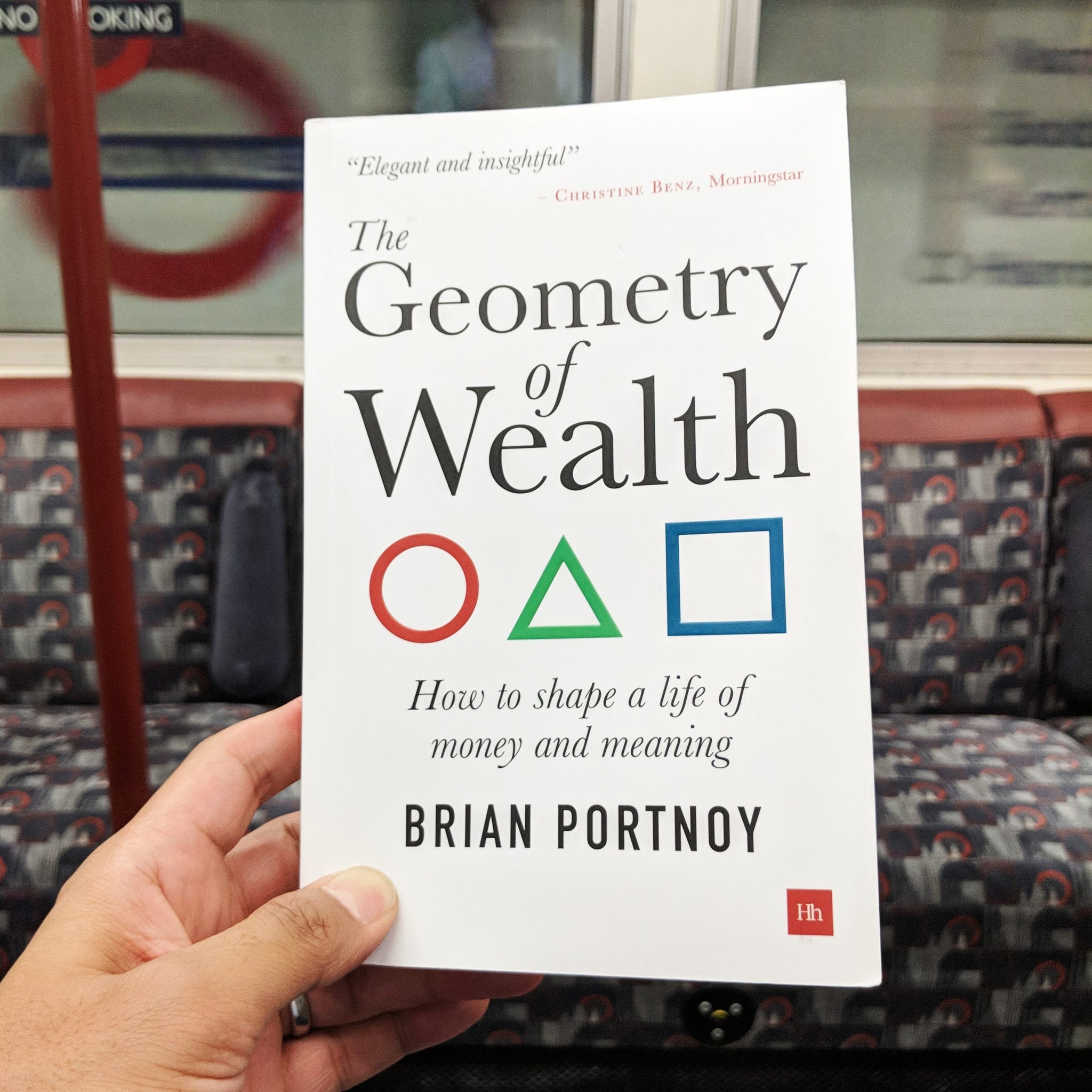

Read MoreI recently read the new book The Geometry of Wealth by Brian Portnoy and found it to be one of the most insightful books on personal finance I have read in years. I love this book because it's not just about money -- it's about life! I highly recommend it to anyone interested in building wealth and using your wealth to underwrite a meaningful life.

Read MoreLet's talk about your financial behavior and why it matters. When I work with clients, we focus on what you can control vs. what you can't control. You can't control what the markets will do this month, this year, or even tomorrow! Here's what you can control:

Read MoreHow's that for an attention-getting title? The tips I share in this post are all pretty simple and basic, but I’ve seen them transform the lives of my clients because it fundamentally changes the way they think about spending and saving.

Read More